How to get Tax residency info for Google Adsense

Navigating the process of obtaining a Certificate of Residence from HMRC has become tricky. Specifically, UK residents managing foreign income or gains often require this certificate to validate their tax residency in the UK. This requirement extends to a diverse range of entities, including individuals, companies, partnerships, trusts, and various other structures. In the following sections, we outline the step-by-step procedures we found online for different entities, starting with individuals who are advised to complete an online form under the designated section, unless an alternative form from another state is applicable, in which case it should be sent to the provided address in the same section.

In this Article

- How to Request Tax Residency info from HMRC for Individuals?

- How to Request a Certificate of Residence from HMRC for Companies?

- How to Request a Certificate of Residence from HMRC for Partnerships?

- How to Request Tax Residency info from HMRC for Trusts?

- How to Request Tax Residency info from HMRC for Registered Pension Schemes?

- How to Request a Certificate of Residence from HMRC for Charities?

- How to contact HMRC Tax by Phone

- How to contact HMRC Tax by Post

- FAQ’s tax residency

- How to get a tax residency certificate for Australia

- Resources:

- 12/01/2024 UPDATE Did you get accepted?

- Update 16/01/2024 – Google knows there is a problem with this process

- Update 22nd Jan 2024 I received my Company Tax Residency Document

- Update 31st Jan 2024 – Google still didn’t accept the new document

- Update 1st Feb 2024 – This sounds promising

- Update 17th Feb 2024 – How I removed the red bar on Google AdSense asking for Tax residency proof?

- Done – No more red bar or Section Asking for Tax residency

We found a lot of this information online while trying to fill out my form. Please seek out a legal or tax expert to ensure this meets your requirements. I am unable to offer advice on your circumstances. I found the direct.gov website useful as it sets out most of the steps you need to get Tax residency info. More resources will be linked below this article

Zulf

How to Request Tax Residency info from HMRC for Individuals?

For individuals seeking a Certificate of Residence from HMRC, follow these steps:

- Complete the online form located under the section “UK residents – claiming tax relief or exemption for foreign income or gains.” The form can be found in the provided link.

How to Request a Certificate of Residence from HMRC for Companies?

For companies under Large Business Service:

- Send requests digitally using the RES1 online service.

- For other companies under Local Compliance, send all requests digitally using the RES1 online service.

How to Request a Certificate of Residence from HMRC for Partnerships?

- Partnerships under Large Business Service or Large Partnership Unit should send requests to the designated contact person.

- Other partnerships should make requests digitally using the RES1 online service.

How to Request Tax Residency info from HMRC for Trusts?

Send requests for trusts to the following address:

HM Revenue and Customs Trusts BX9 1EL United Kingdom

How to Request Tax Residency info from HMRC for Registered Pension Schemes?

- Registered pension schemes should use form APSS 146E for requests.

- Email a scanned PDF copy to pensionschemes@hmrc.gov.uk or post the completed form to the specified address.

- If a third party is involved, provide additional forms APSS 146C and APSS 146D unless prior authorizations are confirmed in writing.

How to Request a Certificate of Residence from HMRC for Charities?

Charities should send requests to: Charities, Savings and International 2 HM Revenue and Customs BX9 1BU charitiesrepaymentqueries@hmrc.gov.uk

How to contact HMRC Tax by Phone

Call HMRC for help with general Corporation Tax enquiries.

You’ll need your 10 digit Unique Tax Reference (UTR) that will be on all letters from HMRC and HMRC online services.

Our advisers cannot give you this reference over the phone.

You can ask for a copy of your Corporation Tax UTR if you do not know it.

If you are a large business, contact your Customer Compliance Manager.

It can take up to 30 working days to send out your document so make sure it has been 30 working days before you call them

Telephone:

0300 200 3410

Outside UK:

+44 151 268 0571

Press 3 for ref if you don’t know it UTR – Unique Tax ReferencePress 7 for tax residency

Opening times:

Our phone line opening hours are:

Monday to Friday: 8am to 6pm

Closed weekends and bank holidays.

You can also find out information in your personal tax account or business tax account using HMRC online services.

Best time to call:

Phone lines are less busy between 8.30am and 11am.

How to contact HMRC Tax by Post

Write to HMRC for help with general Corporation Tax enquiries.

If you have a Unique Tax Reference include it in your letter and on the first page of any documents you send.

You do not need to include a street name, city name or PO box when writing to this address.

Couriers should use a different address.

Corporation Tax Services

HM Revenue and Customs

BX9 1AX

United Kingdom

If you’re replying to a letter you’ve received about your Corporation Tax, you should use the address on that letter.

HMRC’s peak period for Corporation Tax returns is from December to April.

If you are waiting for a repayment from a claim, do not:

- send in an amended return when the loss carry back claim has already been made on the loss-making accounting period

- submit a duplicate claim in writing

Resubmitting your claim may increase the time for us to review and process your claim.

FAQ’s tax residency

You need to provide official taxpayer proof issued by the country of AdSense account registration. For example tax residency certificate. Find this by going to https://adsense.google.com/start/

Certificates of residence confirm that double tax relief or treaty relief is accepted in respect of particular income or earnings. In some cases, a certificate or residence permit is required to avoid paying higher tax

You should only apply for a certificate of residence if you have had tax deducted from the income of a non-UK investment and you wish to reclaim the tax back from an overseas tax authority. You can also use this form to request certification of tax reclaim forms from overseas tax authorities.

A form is available online from HMRC to enable UK tax resident individuals to apply for a certificate of UK tax residence. You can claim tax relief in another country if you pay tax on your foreign income.

This requirement is normally from international agreements. It can help tax authorities understand the right tax you should pay and which country you pay your tax to.

Sign in to your Google payments account. Click Settings on the top right side of the page. Click the edit icon (edit) next to your country’s tax info and enter all required information. Click Save. This video shows the steps

You can see how I filled out my form and what I supplied to see if that helps you, I cover my steps here

Yes, it seems at the end of 2023 start of 2024 Google AdSense checks is asking creators for “extra” new tax information in the form of a Tax residency certificate. YOu can read more about how to get one in this article

How to get a tax residency certificate for Australia

Certificate of residency

A certificate of residency is a document that shows, for a specific period, you were:

an Australian resident for tax purposes

not a temporary resident

liable to pay tax on worldwide income in Australia.

You may need a certificate of residency to give to an overseas tax authority to show you were an Australian resident and that you were liable to pay Australian income tax on worldwide income.

To request a certificate of residency, see:

Certificate of residency and certification of overseas tax relief request form for individuals

Certificate of residency and certification of overseas tax relief request form for non-individuals.

I found a lot of this information online while trying to fill out my form. Please seek out a legal or tax expert to ensure this meets your requirements. I am unable to offer advice on your circumstances. I found the direct.gov website useful as it sets out most of the steps you need to get Tax residency info.

Resources:

What documents suffice as proof of tax residency?

Anyone from the UK dealt with that Ireland tax form?

Tax residency information and Non-US withholding & reporting

Which Article of the country’s double taxation agreement covers the income in this request Ireland: tax treaties

12/01/2024 UPDATE Did you get accepted?

Did this work? NO – I sent a personal Tax residency certificate for a Company account I was expecting that would be an issue.

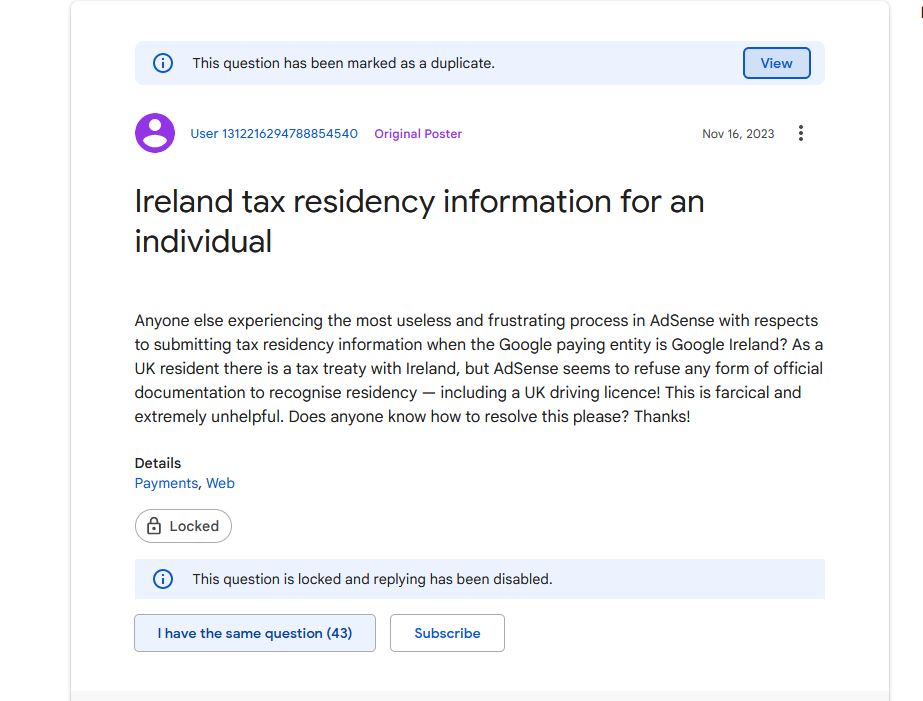

However, I can see on the Google forum over 40 people have this issue even after submitting the right document you can see this post here

So what now?

I have already requested my company residency document and that can take up to 30 days as I requested that on 11th November 2023 I need to wait until the 25th Jan 2024 to call HMRC to see if it hasn’t arrived by then.

I will provide another update when I submit that to see if that works. As it appears nothing is being accepted.

I did a few things today I contacted Google via the community chat feature they did not offer any help

I also contacted YouTube support from my Creator studio who told me it’s not their department. For the moment we are alone.

This is the Google email I got after speaking with the support they said to go here which sends you to the support community where they block people asking questions so it may seem they are not helping and actively stopping people asking for help you will note the note “This question has been locked and replying has been disabled”

Update 16/01/2024 – Google knows there is a problem with this process

I did a little more digging and found there are a few Google product experts who had made reference to this issue and mentioned there are some problems. There may be updates in the future. here is that reference and a glimpse at the message

Update 22nd Jan 2024 I received my Company Tax Residency Document

I received the COMPANY Tax residency document I requested following this process. It took a very long time to come but I have submitted this into Google AdSense.

Update 31st Jan 2024 – Google still didn’t accept the new document

There is an issue as mentioned above referring to the update 16/01/2024 It appears even if you have the correct document it still declines to accept it. To be clear Adsense has declined to accept the Company tax residency document that it requested, I feel I will need to wait to see when we get updates from Google Communities.

Update 1st Feb 2024 – This sounds promising

I saw the below reply from Ben a Product expert to a comment you can see that thread here

BenMcc

PE: Play Console – Not a Google employee

Jan 16, 2024Hi Kevin,

Don’t worry everyone is having problems here (myself included) Google are working on it and say it won’t affect any payouts etc so at the moment the only real issue is the warning messages people are seeing – no action will be taken so you ignore it for now!

Ben

BenMcc Diamond Product Expert

Update 17th Feb 2024 – How I removed the red bar on Google AdSense asking for Tax residency proof?

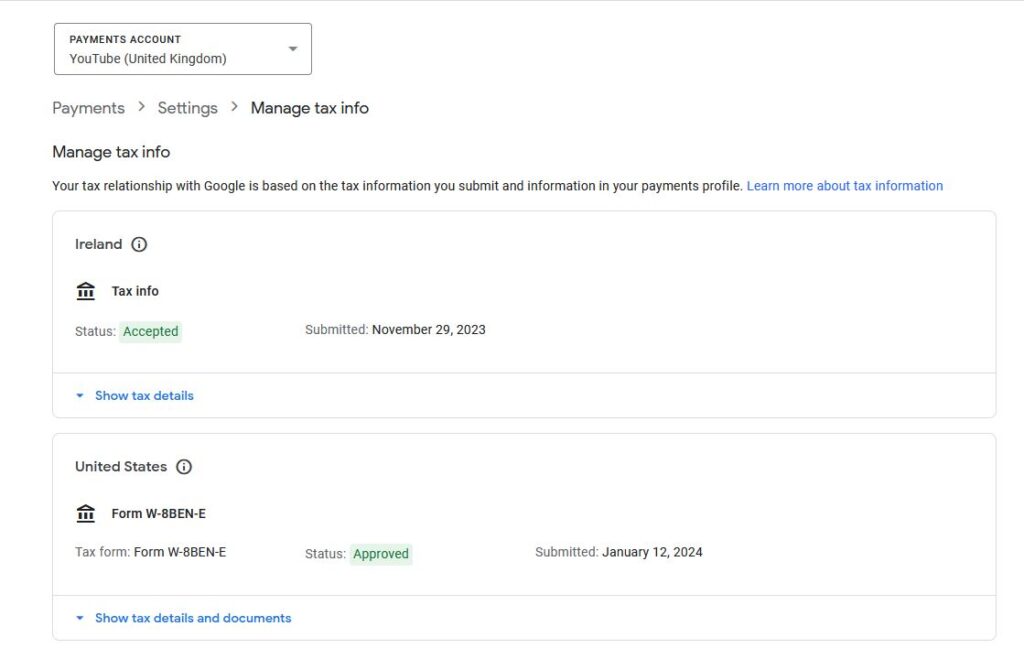

I’m not sure if this is the correct solution, but here are the steps I followed to address the issue of the annoying red bar: Based on reading and researching everything above.

Sign in to your AdSense account. Click PaymentsPayments info. Click Manage settings. Scroll to ‘Payments profile’ and click edit

next to the section Click Manage tax info.

- Follow the steps above to get to the tax document section

- Located the Tax residency document section where I had uploaded the document.

- Clicked on the delete icon next to the current documents.

- Confirmed the decision in the popup that appeared, which warned about starting the process from scratch.

- After deleting the forms, I logged out of AdSense and logged back in.

- Checked to see if all warnings disappeared and if everything was displayed in green.

- Verified that the Ireland double taxation avoidance was accepted.

- Noticed that there was no option to start a new form, indicating that everything seemed fine across Google’s services related to payments.

To provide context to the issue:

- Initially, I proved Ireland double taxation avoidance by providing a Tax Residence Certificate.

- Although Ireland Tax info was accepted, an unexpected issue (thing B) related to Tax Residence Certificate rejection without mentioning Ireland persisted.

- This issue seemed to be caused by the creation of an “Edit mode” for documents during the initial upload to avoid Ireland double taxation.

- Despite Ireland Tax info being accepted, the system did not recognise the acceptance of Tax residence when Ireland double taxation was under review and accepted.

Done – No more red bar or Section Asking for Tax residency

I followed the steps I shared above and here is what my AdSense looks like below